The Basics: What are managed accounts?

A managed account is a customized, professionally managed solution for a retirement plan participant, generally through a provider that may serve as a 3(38) fiduciary at the participant level. The portfolio is personalized for an individual based on factors such as age, salary, contribution rate, risk tolerance, and out-of-plan assets. This solution typically involves an additional fee, usually paid by the participants who choose the option.

The appeal is a more precise alignment of investments to meet a participant’s changing personal needs. Managed accounts also can have a beneficial impact on saving: Studies show that participants of all ages save more when they utilize a managed account. 1

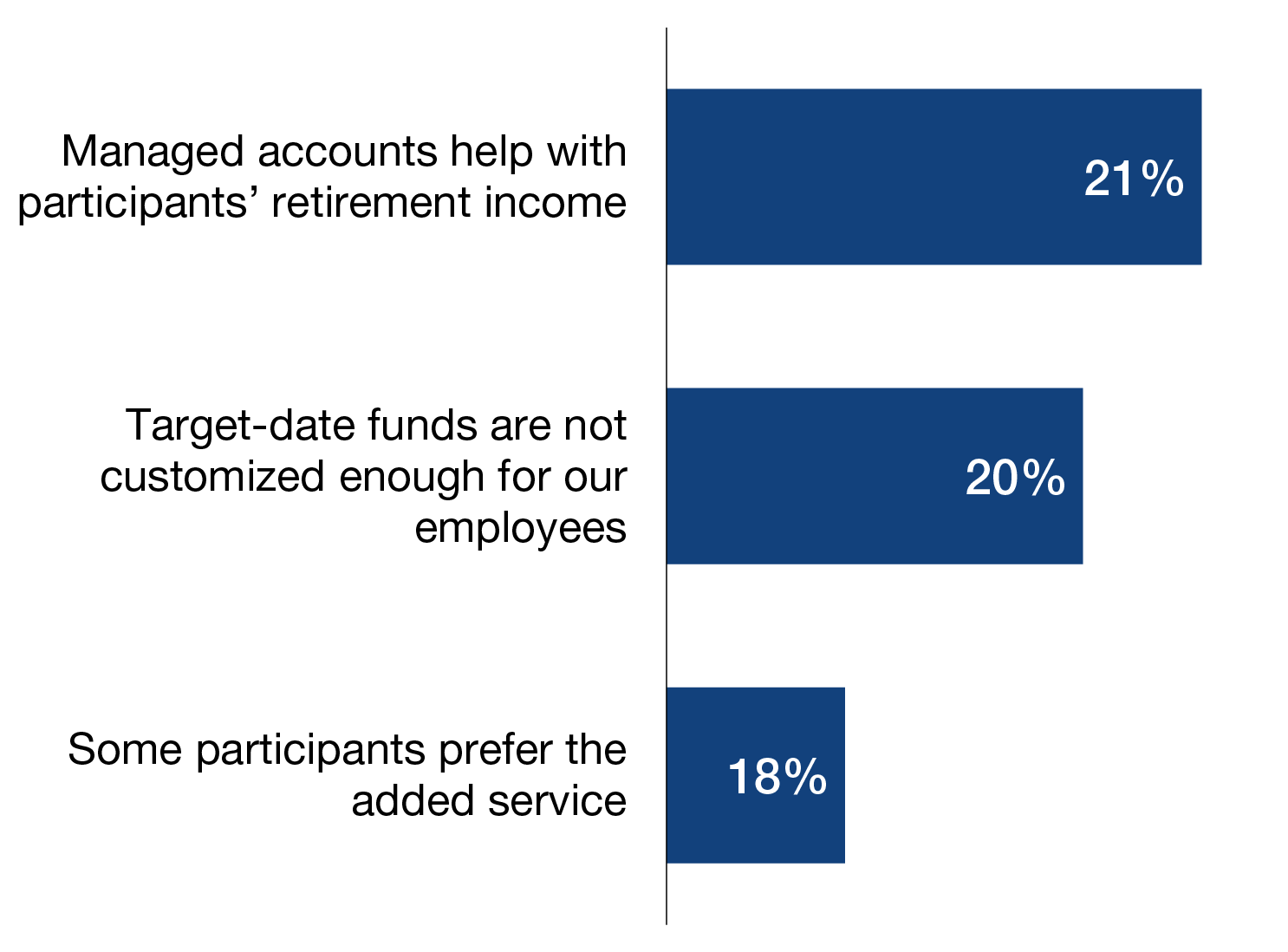

Managed accounts are poised for takeoff. Why? Personalization.

Managed account solutions in DC plans have steadily increased over the last decade. Once considered a less common investment option, managed accounts have become a growth area for many providers. Assets have risen from $108 billion in 2012 to $348 billon in 2019. 2

87% of DC recordkeepers offer managed accounts as an in-plan retirement income solution. 47% of plan sponsors offer managed accounts within their retirement plan. More than half (54%) of sponsors within the large plan segment offer a managed account program.4

Many experts attribute their growing appeal to a trend towards personalization in the DC environment. Dan Bruns, Head of Managed Solutions at Morningstar Investment Management, feels personalization’s time has come. “Consider target date funds. They were introduced in 1994, took off after 2006 following the Pension Protection Act, yet today, by and large, they are still pretty much the same. They structurally have not changed,” he says. “But in so many other aspects of our lives, personalization has taken over. Personalization is the big trend that we see happening in the DC market.” he says. 5

Other experts note that innovations in personalization are improving the participant experience. Ken Verzella, Vice President, Participant Advisory Services at Empower says: “We are seeing enhanced participant engagement strategies and a more modernized user experience to capture what we call ‘active personalization.’” 6

Shawn O’Brien, senior analyst, Cerulli, explains: “Rather than having participants manually gather and transmit a variety of personal data points to their managed account provider, several platforms now automatically extract participant-level data from the recordkeeper, effectively streamlining the data aggregation process.” 7

Another Appeal: Retirement income

Together with personalized advice, managed accounts can help optimize participants’ retirement savings, investment allocation and income generation strategies. The higher level of advice can help participants of all ages with financial planning in preparation for, during transition, and through retirement.

What should plan sponsors watch for with managed account providers? “You should be seeing a holistic approach and very comprehensive investment advice, covering the draw down and spend down recommendations for retirement income,” Ken Verzella recommends.

How do Managed Accounts differ from Target Date Funds?

Menu Construction: One or the other, or both?

Many experts view them as companions on a plan menu, not one or the other. Empower’s Ken Verzella says: “We view managed accounts as complementary to TDFs, not necessarily as a substitute.” He adds: “They both serve an important role in a thoughtfully designed retirement benefit.” 6

Morningstar’s Dan Bruns agrees. “The old argument was that you chose one or the other. I don’t buy that,” he says. “For most plans, both TDFs and managed accounts should live together on the menu.” 5

When target date funds and managed accounts are offered together, it has the positive effect of increasing the total number of participants who are using a professionally managed investment option, typically a goal plan sponsors pursue.

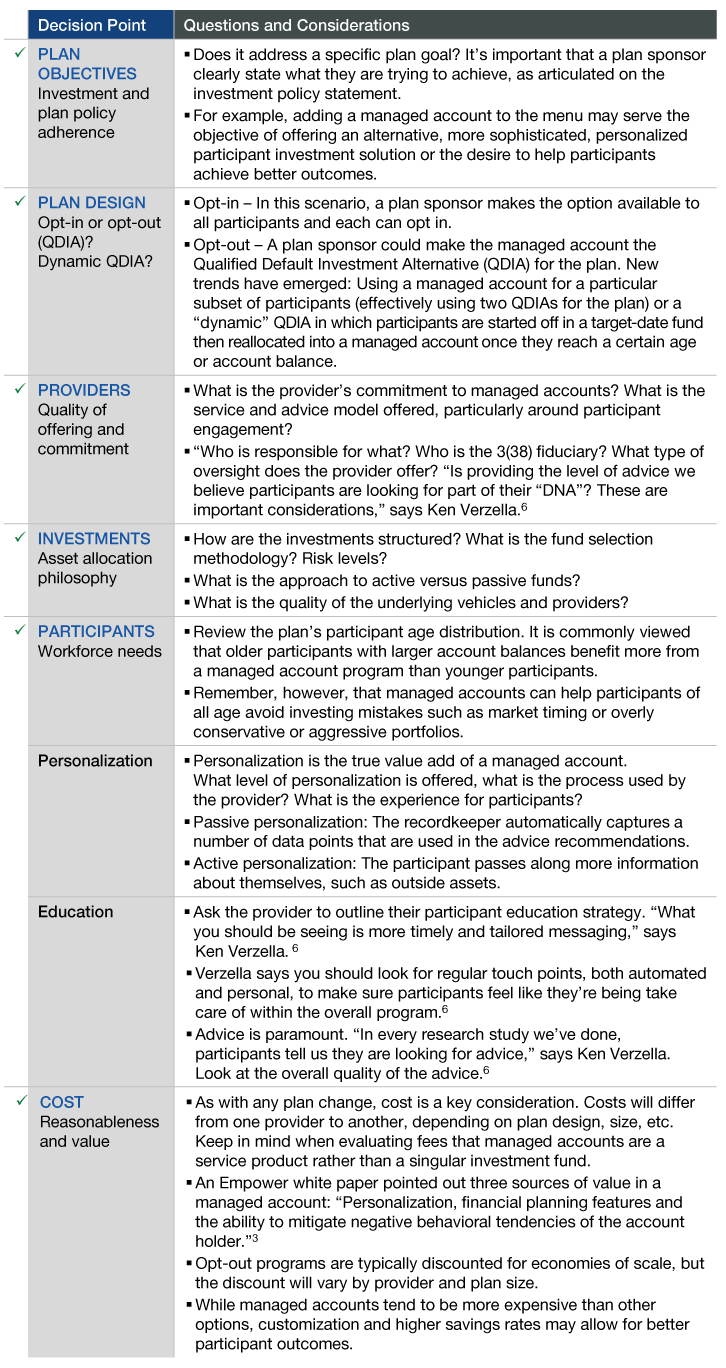

Evaluating managed accounts for your plan

Adding managed accounts as an investment solution for retirement plan participants is a broad and complex topic with many factors that vary by provider, plan design and quality of advice.

Based on their research, Cerulli believes that managed account adoption will continue to steadily increase not only as a personalized decumulation vehicle, but as an alternative default investment option. 4

Reviewing this solution with a retirement advisor with experience in this area is highly suggested. We have compiled this comprehensive checklist to support retirement plan sponsors in considering managed account solutions.

Managed Accounts: A Plan Sponsor Decision Checklist

To learn more about managed account solutions, consult your retirement plan advisor and your local Lord Abbett Regional Director.

1 Blanchet, David, The Impact of Managed Accounts on Participant Savings and Investment Decisions, Morningstar, January 22, 2019.

2 Pensions & Investments and Cerulli Associates, April 2020

3 “Made to measure: Evaluating the impact of a retirement managed account,” Empower, 2018

4 The Cerulli Report, U.S. Retirement Markets 2021, Solidifying Relationships with Plan Sponsors and Participants

5 Interview with Dan Bruns, Head of Managed Solutions, Morningstar Investment Management, December 17, 2021

6 Interview with Ken Verzella, Vice President, Participant Advisory Services, Empower, December 20, 2021

7 Godbout, Ted, “Cerulli: How Managed Accounts Are Evolving,” NAPA, March 16, 2021

The information provided is not directed at any investor or category of investors and is provided solely as general information about Lord Abbett’s products and services and to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither Lord Abbett nor its affiliates are undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product or service may be appropriate for your circumstances.