In Brief

- News that the dividend yield on the S&P 500® index now exceeds the yield on 10-year U.S. Treasury notes has brought renewed attention to dividend-paying stocks.

- However, we believe some popular dividend-investment vehicles lean too heavily on “bond proxies,” i.e., higher-yielding stocks from a narrow range of sectors with low growth, and therefore, less chance of stock-price appreciation.

- Instead, we think investors may wish to consider a strategy that seeks to identify the most attractive dividend stocks from all sectors, potentially enabling them to benefit from dividend income and a greater chance of capital appreciation.

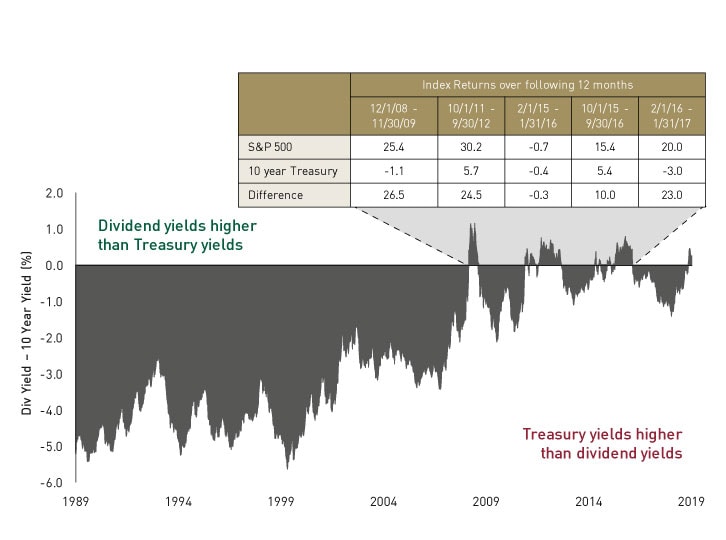

Chart 1. U.S. Dividend Yields Recently Exceeded 10-Year U.S. Treasury Yields

For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment. Dividends are not guaranteed and may be increased, decreased, or suspended altogether at the discretion of the issuing company.

Past performance is not a reliable indicator or guarantee of future results.

Moreover, historically when the S&P 500 dividend yield overtook the 10-year U.S. Treasury yield, the subsequent 12-month return was positive with the exception of 2015. The average 12-month return over the five periods depicted in the table that accompanies Chart 1 was approximately 18%. This suggests that not only are dividend paying stocks attractive from an income standpoint, but also that equity markets have the potential for robust positive total returns in the coming year.

However, we would note that not all dividend-focused strategies are the same. Equity income funds often have an overconcentration in sectors that pay a high dividend yield, but do not offer much potential for capital appreciation. The return profiles of these stocks have prompted investors to label them as “bond proxies.” These stocks are commonly found within the utilities, communications services (primarily telecom services), real estate, and consumer staples sectors. While bond proxy sectors are attractive in a low interest rate environment, performance is usually whipsawed when rates rise.

Investors considering a dividend-focused strategy should be wary of major sector biases. In fact, several major dividend income exchange-traded funds (ETFs) exhibit sector biases toward bond proxy sectors. As of October 2, 2019, two of the largest dividend ETFs, SPDR S&P Dividend ETF (SDY) and iShares Select Dividend ETF (DVY), were both overweight in bond proxy sectors relative to the S&P 500, based on FactSet data. The SPDR S&P Dividend ETF had an overweight allocation relative to the S&P 500 to the consumer staples and utilities sectors of approximately 8% and 7% respectively. Meanwhile, the iShares Select Dividend ETF maintained an overweight position relative to the S&P 500 in the utilities sector of roughly 23%.

While there are several large, dividend-paying companies within these bond proxy sectors, we think dividend investors should consider expanding their horizons. For, as Chart 2 shows, the universe of dividend-paying equities is quite broad.

Chart 2. Bond Proxies Represent Only One-Quarter of Dividend-Paying Stocks

For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment and are not intended to predict or depict future results. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

CLOSE-UP

“Bond Proxies” and Rising Rates

Since “bond proxies” are typically low- or no-growth stocks, their dividend payout is often a sizeable portion of their overall total return. So we think it would be no surprise that they tend to underperform when a spike in interest rates makes their dividend yields relatively less attractive. As the accompanying chart highlights, the classic bond proxy sectors were the relative laggards during the two most recent periods of rising rates: July 8, 2016–March 13, 2017, when the broader equity market (as represented by the S&P 500® Index) delivered a return of 13%; and September 7, 2017–November 8, 2018, when the market returned 16%.

“Bond Proxies” Have Underperformed During Periods of Rising Rates

For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment. In September 2018 GICS changed the name of the Telecommunication Services sector to Communication Services. In addition to the name change, certain companies that were previously included in the Technology and Consumer Discretionary sectors are now included in the Communication Services sector.

Past performance is not a reliable indicator or guarantee of future results.

“Bond Proxies” Have Underperformed During Periods of Rising Rates

For illustrative purposes only and does not represent any specific portfolio managed by Lord Abbett or any particular investment. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment. In September 2018 GICS changed the name of the Telecommunication Services sector to Communication Services. In addition to the name change, certain companies that were previously included in the Technology and Consumer Discretionary sectors are now included in the Communication Services sector.

Past performance is not a reliable indicator or guarantee of future results.

About the Author

A Note about Risk: The value of investments in equity securities will fluctuate in response to general economic conditions and to changes in the prospects of particular companies and/or sectors in the economy. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as their volatility can be substantial. Value investing involves the risk that the market may not recognize that securities are undervalued, and they may not appreciate as anticipated. Smaller companies tend to be more volatile and less liquid than larger companies. Small cap companies may also have more limited product lines, markets, or financial resources and typically experience a higher risk of failure than large cap companies. The value of an investment in fixed-income securities will change as interest rates fluctuate and in response to market movements. As interest rates fall, the prices of debt securities tend to rise. As rates rise, prices tend to fall.

No investing strategy can overcome all market volatility or guarantee future results.

Dividends are not guaranteed and may be increased, decreased, or suspended altogether at the discretion of the issuing company.

Forecasts and projections are based on current market conditions and are subject to change without notice. Projections should not be considered a guarantee.

This article may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that markets will perform in a similar manner under similar conditions in the future.

Treasuries are debt securities issued by the U.S. government and secured by its full faith and credit. Income from Treasury securities is exempt from state and local taxes.

Dividend yield is equal to the dividend divided by the stock price. Dividend yield is one measure of a stock's value. A high dividend yield may indicate that a stock is relatively inexpensive.

Dividend policy: A stock is classified as a dividend payer if it paid a cash dividend any time during the previous 12 months, a dividend grower if it initiated or raised its cash dividend at any time during the previous 12 months, and non-dividend payer if it did not pay a cash dividend at any time during the previous 12 months.

Exchange Traded Fund (ETF) is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. ETFs experience price changes throughout the day as they are bought and sold.

Yield is the annual interest received from a bond and is typically expressed as a percentage of the bond's market price.

The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index.

The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

Indexes are unmanaged, do not reflect deduction of fees and expenses and are not available for direct investment.

The information provided is not directed at any investor or category of investors and is provided solely as general information about Lord Abbett’s products and services and to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither Lord Abbett nor its affiliates are undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product or service may be appropriate for your circumstances.

The opinions in Market View are as of the date of publication, are subject to change based on subsequent developments, and may not reflect the views of the firm as a whole. The material is not intended to be relied upon as a forecast, research, or investment advice, is not a recommendation or offer to buy or sell any securities or to adopt any investment strategy, and is not intended to predict or depict the performance of any investment. Readers should not assume that investments in companies, securities, sectors, and/or markets described were or will be profitable. Investing involves risk, including possible loss of principal. This document is prepared based on the information Lord Abbett deems reliable; however, Lord Abbett does not warrant the accuracy and completeness of the information. Investors should consult with a financial advisor prior to making an investment decision.