NOT FDIC INSURED–NO BANK GUARANTEE–MAY LOSE VALUE

The Lord Abbett Credit Opportunities Fund is structured as an unlisted closed-end interval fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly offers to repurchase between 5% and 25% of its outstanding shares at net asset value, subject to applicable law and approval of the Board of Trustees. The Fund currently expects to offer to repurchase 5% of outstanding shares per quarter. There is no secondary market for the Fund’s shares, and none is expected to develop. There is no guarantee that an investor will be able to tender all or any of their requested Fund shares in a periodic repurchase offer. Investors should consider shares of the Fund to be an illiquid investment.

Although the Fund may impose a repurchase fee of up to 2.00% on shares accepted for repurchase by the Fund that have been held for less than one year, the Fund does not currently intend to impose such a fee. Please refer to the Fund's prospectus for additional information.

The Fund’s ability to be fully invested and achieve its investment objective may be affected by the need to fund repurchase obligations. In addition, the fees and costs associated with investing in an interval fund may be significantly greater than those of other fund structures.

New Fund Risk: The Fund is newly organized. There can be no assurance that the Fund will reach or maintain a sufficient asset size to effectively implement its investment strategy.

A Note about Risk: The Fund is subject to the general risks associated with investing in debt securities, including market, credit, liquidity, and interest rate risk. The Fund may invest in high yield, lower-rated securities, sometimes called junk bonds. These securities carry increased risks of price volatility, illiquidity, and the possibility of default in the timely payment of interest and principal. The Fund may invest in debt securities of stressed and distressed issuers as well as in defaulted securities and debtor-in-possession financings, all of which may be considered Special Situations. Distressed and defaulted instruments generally present the same risks as investment in below-investment-grade instruments. However, in most cases, these risks are of a greater magnitude because of the uncertainties of investing in an issuer undergoing financial distress. The Fund may invest in foreign or emerging market securities, which may be adversely affected by economic, political, or regulatory factors and subject to currency volatility and greater liquidity risk. The Fund may invest in derivatives, which are subject to greater liquidity, leverage, and counterparty risk. These factors can affect Fund performance.

Because of the risks associated with the Fund’s ability to invest in high yield securities, loans and related instruments, and mortgage-related and other asset-backed instruments, foreign (including emerging market) securities (and related exposure to foreign currencies), and the Fund’s ability to use leverage, an investment in the Fund should be considered speculative and involving a high degree of risk, including the risk of a substantial loss of investment.

The Fund's portfolio is actively managed and is subject to change.

Unless otherwise noted, all discussions are based on U.S. markets and U.S. monetary and fiscal policies.

Asset allocation or diversification does not guarantee a profit or protect against loss in declining markets.

No investing strategy can overcome all market volatility or guarantee future results.

The value of investments and any income from them is not guaranteed and may fall as well as rise, and an investor may not get back the amount originally invested. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance.

Market forecasts and projections are based on current market conditions and are subject to change without notice.

Projections should not be considered a guarantee.

Equity Investing Risks

The value of investments in equity securities will fluctuate in response to general economic conditions and to changes in the prospects of particular companies and/or sectors in the economy. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as their volatility can be substantial. Value investing involves the risk that the market may not recognize that securities are undervalued, and they may not appreciate as anticipated. Smaller companies tend to be more volatile and less liquid than larger companies. Small cap companies may also have more limited product lines, markets, or financial resources and typically experience a higher risk of failure than large cap companies.

Fixed-Income Investing Risks

The value of investments in fixed-income securities will change as interest rates fluctuate and in response to market movements. Generally, when interest rates rise, the prices of debt securities fall, and when interest rates fall, prices generally rise. High yield securities, sometimes called junk bonds, carry increased risks of price volatility, illiquidity, and the possibility of default in the timely payment of interest and principal. Bonds may also be subject to other types of risk, such as call, credit, liquidity, and general market risks. Longer-term debt securities are usually more sensitive to interest-rate changes; the longer the maturity of a security, the greater the effect a change in interest rates is likely to have on its price.

The credit quality of fixed-income securities in a portfolio is assigned by a nationally recognized statistical rating organization (NRSRO), such as Standard & Poor’s, Moody’s, or Fitch, as an indication of an issuer’s creditworthiness. Ratings range from ‘AAA’ (highest) to ‘D’ (lowest). Bonds rated ‘BBB’ or above are considered investment grade. Credit ratings ‘BB’ and below are lower-rated securities (junk bonds). High-yielding, non-investment-grade bonds (junk bonds) involve higher risks than investment-grade bonds. Adverse conditions may affect the issuer’s ability to pay interest and principal on these securities.

Glossary & Index Definitions

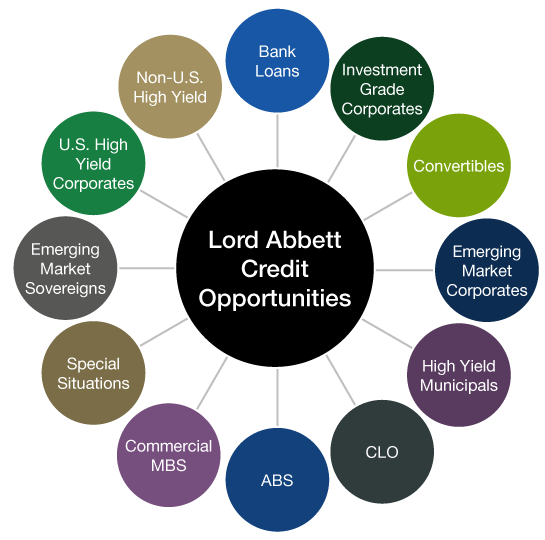

Bank Loans or Leveraged Loans are loans extended to companies or individuals that already have considerable amounts of debt. Lenders consider leveraged loans to carry a higher risk of default and, as a result, a leveraged loan is more costly to the borrower.

Convertible bond is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features.

Collateral Loan Obligation (CLO) is a special purpose vehicle (SPV) with securitization payments in the form of different tranches. Financial institutions back this security with receivables from loans. Collateralized loan obligations are the same as collateralized mortgage obligations (CMOs) except for the assets securing the obligation. CLOs allow banks to reduce regulatory capital requirements by selling large portions of their commercial loan portfolios to international markets, reducing the risks associated with lending.

Asset-Backed Security (ABS) is a financial security backed by a loan, lease or receivables against assets other than real estate and mortgage-backed securities. For investors, asset-backed securities are an alternative to investing in corporate debt.

Commercial Mortgage-Backed Security (CMBS) is a type of mortgage-backed security that is secured by the loan on a commercial property. A CMBS can provide liquidity to real estate investors and to commercial lenders. As with other types of MBS, the increased use of CMBS can be attributable to the rapid rise in real estate prices over the years.

The Federal Reserve System (Fed) is the central bank of the United States and is governed by the Federal Reserve Board. The Federal Open Market Committee (FOMC), the policy-setting arm of the U.S. Federal Reserve, issues projections of the rate of U.S. economic growth at the conclusion of its meetings in March, June, September, and December of each year.

The federal funds (fed funds) rate is the target interest rate set by the Fed at which commercial banks borrow and lend their excess reserves to each other overnight.

A liquidity premium compensates investors for investing in securities with low liquidity. Liquidity refers to how easily an investment can be sold for cash. Liquidity premiums, which are the cost of daily liquidity in the form of lower compensation, or yield, for similar credit risks.

Opportunistic credit investments seek to capitalize on dislocations in credit markets and mispricings that can occur in fixed-income markets.

Private credit covers an array of strategies that span the capital structure and borrower type. These range from senior secured loans for blue-chip corporate borrowers, to junior unsecured credit for financing new building construction, to loans against specialized assets such as railcars and airplanes or contractual revenue streams like royalties and subscription services, to distressed situations.

Yield is the income returned on an investment, such as the interest received from holding a security. The yield is usually expressed as an annual percentage rate based on the investment's cost, current market value, or face value. Yield-to-maturity (YTM) represents the expected return (expressed as an annualized rate) from the bond’s future cash flows, including coupon payments over the life of the bond and the bond’s principal value received at maturity. Yield-to-worst refers to the lesser of a bond’s (a) yield-to-maturity or (b) the lowest yield-to-call calculated on each scheduled call date.

Yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. One such comparison involves the two-year and 10-year U.S. Treasury debt. This yield curve is used as a benchmark for other debt in the market, such as mortgage rates or bank lending rates. The curve is also used to predict changes in economic output and growth.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

The views and opinions expressed are as of the date of publication, and do not necessarily represent the views of the firm as a whole. Any such views are subject to change at any time based upon market or other conditions, and Lord Abbett disclaims any responsibility to update such views. Lord Abbett cannot be responsible for any direct or incidental loss incurred by applying any of the information offered.

This material is provided for general and educational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Lord Abbett product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice.

Please consult your investment professional for additional information concerning your specific situation.

This material is the copyright © 2023 of Lord, Abbett & Co. LLC. All Rights Reserved.

Important Information for U.S. Investors

Lord Abbett mutual funds are distributed by Lord Abbett Distributor LLC.

FOR MORE INFORMATION ON ANY LORD ABBETT FUNDS, CONTACT YOUR INVESTMENT PROFESSIONAL OR LORD ABBETT DISTRIBUTOR LLC AT 888-522-2388, OR VISIT US AT LORDABBETT.COM FOR A PROSPECTUS, WHICH CONTAINS IMPORTANT INFORMATION ABOUT A FUND'S INVESTMENT GOALS, SALES CHARGES, EXPENSES AND RISKS THAT AN INVESTOR SHOULD CONSIDER AND READ CAREFULLY BEFORE INVESTING.

The municipal bond market may be impacted by unfavorable legislative or political developments and adverse changes in the financial conditions of state and municipal issuers or the federal government in case it provides financial support to the municipality. Income from the municipal bonds held could be declared taxable because of changes in tax laws. Certain sectors of the municipal bond market have special risks that can affect them more significantly than the market as a whole. Because many municipal instruments are issued to finance similar projects, conditions in these industries can significantly affect an investment. Income from municipal bonds may be subject to the alternative minimum tax. Federal, state, and local taxes may apply. Investments in Puerto Rico and other U.S. territories, commonwealths, and possessions may be affected by local, state, and regional factors. These may include, for example, economic or political developments, erosion of the tax base, and the possibility of credit problems.

The information provided is not directed at any investor or category of investors and is provided solely as general information about Lord Abbett’s products and services and to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither Lord Abbett nor its affiliates are undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product or service may be appropriate for your circumstances.

Important Information for non-U.S. Investors

Note to Switzerland Investors: In Switzerland, the Representative is ACOLIN Fund Services AG, Leutschenbachstrasse 50, CH-8050 Zurich, whilst the Paying Agent is Bank Vontobel Ltd., Gotthardstrasse 43, CH- 8022 Zurich. The prospectus, the key information documents or the key investor information documents, the instrument of incorporation, as well as the annual and semi-annual reports may be obtained free of charge from the representative. In respect of the units offered in Switzerland, the place of performance is at the registered office of the representative. The place of jurisdiction shall be at the registered office of the representative or at the registered office or domicile of the investor.

Note to European Investors: This communication is issued in the United Kingdom and distributed throughout Europe by Lord Abbett UK Ltd., a Private Limited Company registered in England and Wales under company number 10804287 with its registered office at Tallis House, 2 Tallis Street, Temple, London, United Kingdom, EC4Y 0AB. Lord Abbett UK Ltd (FRN 783356) is an Appointed Representative of Kroll Securities Limited (FRN 466588), which is authorised and regulated by the Financial Conduct Authority.

Lord Abbett (Middle East) Limited is authorised and regulated by the Dubai Financial Services Authority (“DFSA”). The entire content of this document is subject to copyright with all rights reserved. This research and the information contained herein may not be reproduced, distributed or transmitted in any jurisdiction or to any other person or incorporated in any way into another document or other material without our prior written consent. This document is directed at Professional Clients and not Retail Clients. Any other persons in receipt of this document must not rely upon or otherwise act upon it. This document is provided for informational purposes only. Nothing in this document should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction. Nothing contained in this document constitutes an investment, an offer to invest, legal, tax or other advice or guidance and should be disregarded when considering or making investment decisions.