1J.P. Morgan North American Credit Research, Monthly Default Monitor, 2024, July 1, 2024

2J.P. Morgan North American Credit Research, US High Yield and Leveraged Loan Strategy Report, August 13, 2024

Important Information

Unless otherwise noted, all discussions are based on U.S. markets, U.S. monetary and fiscal policies, and U.S. dollar-denominated index and return data.

Asset allocation or diversification does not guarantee a profit or protect against loss in declining markets.

No investing strategy can overcome all market volatility or guarantee future results.

The value of investments and any income from them is not guaranteed and may fall as well as rise, and an investor may not get back the amount originally invested. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance.

Market forecasts and projections are based on current market conditions and are subject to change without notice. Projections should not be considered a guarantee.

Projections should not be considered a guarantee.

Equity Investing Risks

The value of investments in equity securities will fluctuate in response to general economic conditions and to changes in the prospects of companies and/or sectors in the economy. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as their volatility can be substantial. Value investing involves the risk that the market may not recognize that securities are undervalued, and they may not appreciate as anticipated. Smaller companies tend to be more volatile and less liquid than larger companies. Small cap companies may also have more limited product lines, markets, or financial resources and typically experience a higher risk of failure than large cap companies.

Fixed-Income Investing Risks

The value of investments in fixed-income securities will change as interest rates fluctuate and in response to market movements. Generally, when interest rates rise, the prices of debt securities fall, and when interest rates fall, prices generally rise. High yield securities, sometimes called junk bonds, carry increased risks of price volatility, illiquidity, and the possibility of default in the timely payment of interest and principal. Bonds may also be subject to other types of risk, such as call, credit, liquidity, and general market risks. Longer-term debt securities are usually more sensitive to interest-rate changes; the longer the maturity of a security, the greater the effect a change in interest rates is likely to have on its price.

The credit quality of fixed-income securities in a portfolio is assigned by a nationally recognized statistical rating organization (NRSRO), such as Standard & Poor’s, Moody’s, or Fitch, as an indication of an issuer’s creditworthiness. Ratings range from ‘AAA’ (highest) to ‘D’ (lowest). Bonds rated ‘BBB’ or above are considered investment grade. Credit ratings ‘BB’ and below are lower-rated securities (junk bonds). High-yielding, non-investment-grade bonds (junk bonds) involve higher risks than investment-grade bonds. Adverse conditions may affect the issuer’s ability to pay interest and principal on these securities.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

The views and opinions expressed are as of the date of publication, and do not necessarily represent the views of the firm as a whole. Any such views are subject to change at any time based upon market or other conditions and Lord Abbett disclaims any responsibility to update such views. Lord Abbett cannot be responsible for any direct or incidental loss incurred by applying any of the information offered.

This material is provided for general and educational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Lord Abbett product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Lord Abbett. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Lord Abbett or any other person. While such sources are believed to be reliable, Lord Abbett does not assume any responsibility for the accuracy or completeness of such information. Lord Abbett does not undertake any obligation to update the information contained herein as of any future date.

Please consult your investment professional for additional information concerning your specific situation.

Bloomberg Index Information

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg owns all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall not have any liability or responsibility for injury or damages arising in connection therewith.

Glossary & Index Definitions

Treasuries are debt securities issued by the U.S. government and secured by its full faith and credit.

Income from Treasury securities is exempt from state and local taxes.

A basis point is one one-hundredth of a percentage point.

Capital market liquidity generally is a measure of the ability to convert an asset or security into cash. An efficient capital market may also mean a liquid capital market.

Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

The U.S. Federal Reserve (Fed) is the central bank of the United States.

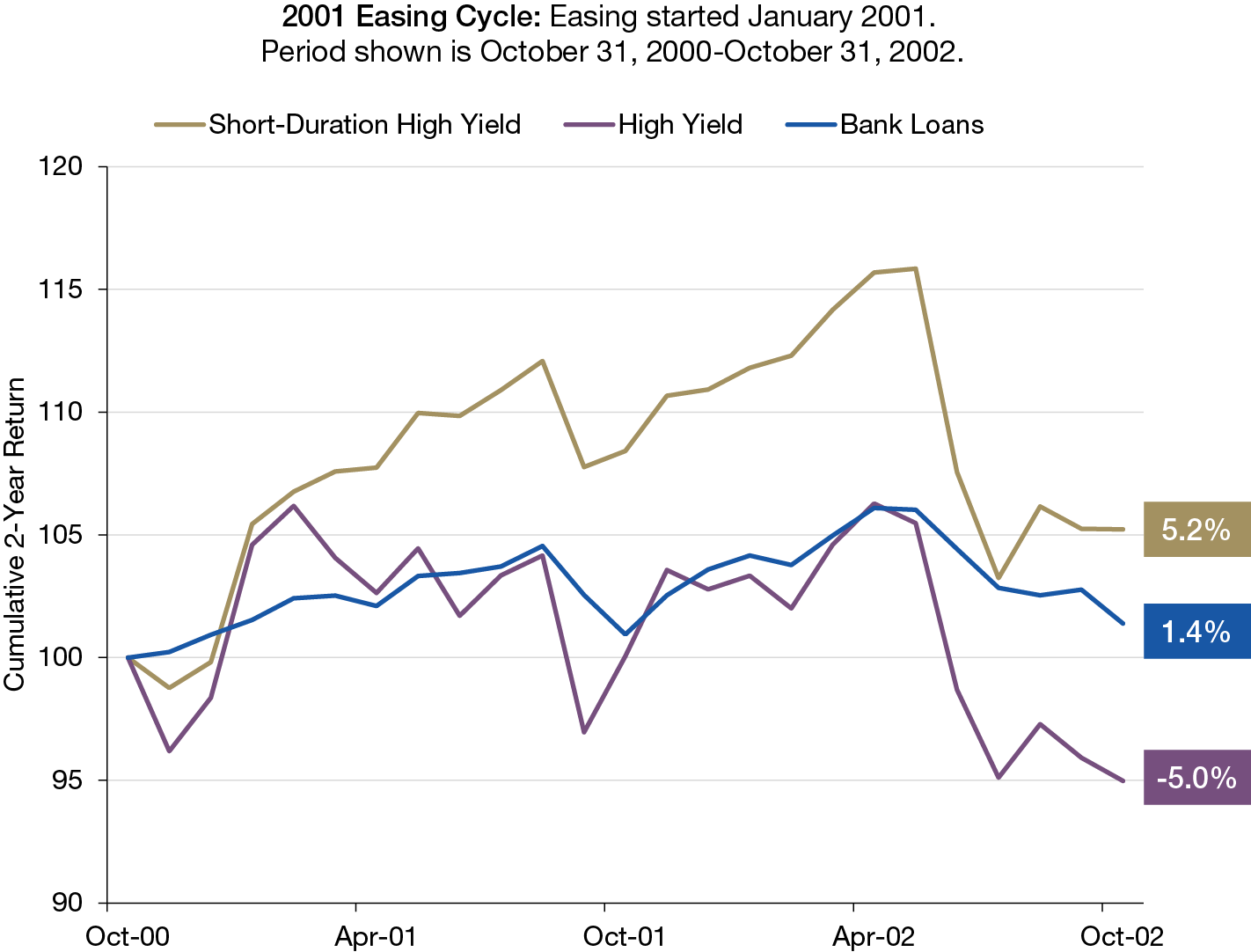

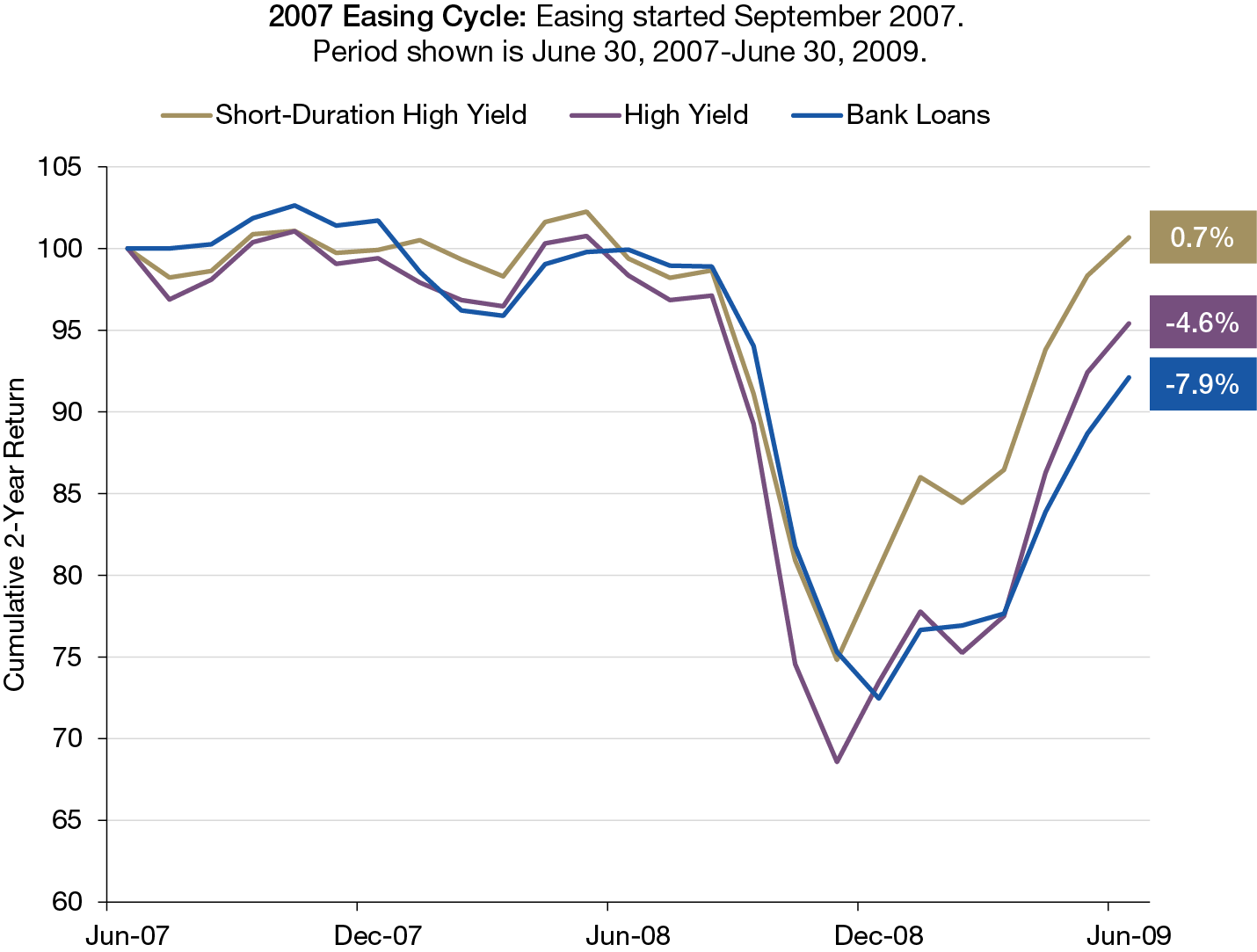

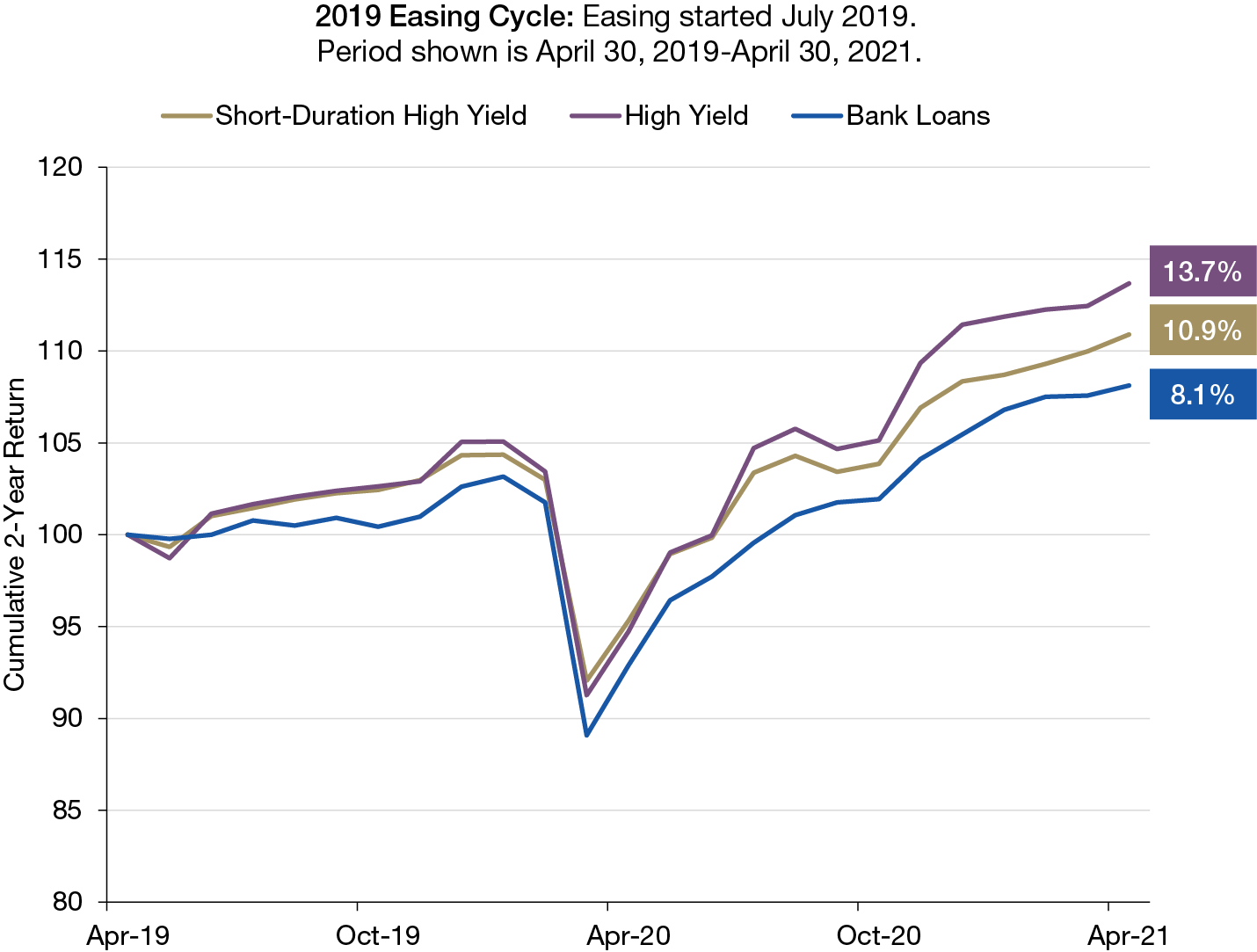

Easing monetary policy or Fed easing is when the central bank lowers short-term interest rates through policy changes to the federal funds rate and discount rate. The central bank tightens policy or makes money tight by raising short-term interest rates through policy changes to the discount rate and federal funds rate.

The federal funds (fed funds) rate is the target interest rate set by the Fed at which commercial banks borrow and lend their excess reserves to each other overnight.

Interest coverage ratio is calculated by dividing a company’s earnings before interest, taxes, depreciation, and amortization by interest expense. The ratio measures a company’s ability to pay the interest on its outstanding debt.

Leverage ratio is a financial metric that measures how much of a company’s capital is derived from debt, such as loans. Leverage ratios are also used to assess the ability of a company to meet its financial obligations.

Macroeconomics is generally the study of economy-wide phenomena such as inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and changes in unemployment.

Spread is the percentage difference in current yields of various classes of fixed-income securities versus Treasury bonds or another benchmark bond measure. A bond spread is often expressed as a difference in percentage points or basis points (which equal one-one hundredth of a percentage point). The option-adjusted spread (OAS) is the measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option. Typically, an analyst uses the Treasury securities yield for the risk-free rate.

Yield is the income returned on an investment, such as the interest received from holding a security. The yield is usually expressed as an annual percentage rate based on the investment’s cost, current market value, or face value. Yield-to-maturity (YTM) represents the expected return (expressed as an annualized rate) from the bond’s future cash flows, including coupon payments over the life of the bond and the bond’s principal value received at maturity. Yield-to-worst refers to the lesser of a bond’s (a) yield-to-maturity or (b) the lowest yield-to-call calculated on each scheduled call date.

Yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three month, two-year, five-year and 30-year U.S. Treasury debt. This yield curve is used as a benchmark for other debt in the market, such as mortgage rates or bank lending rates. The curve is also used to predict changes in economic output and growth.

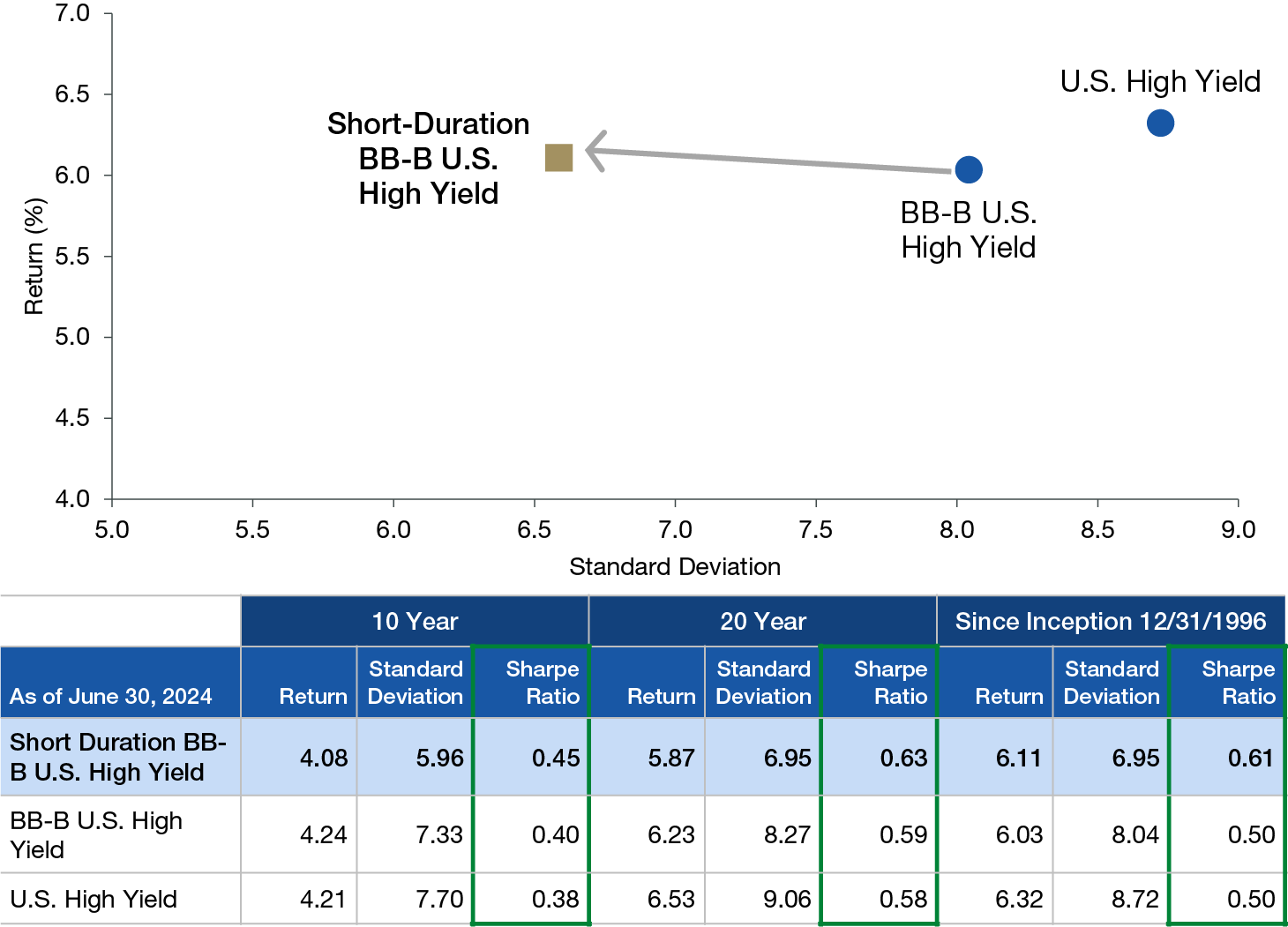

The ICE BofA 1-5 Year High Yield Index is an unmanaged index comprised of U.S. dollar-denominated, high yield debt securities publicly traded in the U.S. domestic market with between one and five years remaining to final maturity.

The ICE BofA BB/B High Yield Index is an unmanaged index comprised of U.S. dollar-denominated, BB- and B-rated debt securities publicly traded in the U.S. domestic market.

The ICE BofA US High Yield Index tracks the performance of U.S. dollar-denominated, below-investment-grade corporate debt publicly issued in the U.S. domestic market. Qualifying securities must have a below-investment-grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

ICE BofA Index Information:

Source: ICE Data Indices, LLC (“ICE”), used with permission. ICE PERMITS USE OF THE ICE BofA INDICES AND RELATED DATA ON AN “AS IS” BASIS, MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/ OR COMPLETENESS OF THE ICE BofA INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THE USE OF THE FOREGOING, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND LORD ABBETT, OR ANY OF ITS PRODUCTS OR SERVICES.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

This material is the copyright © 2024 of Lord, Abbett & Co. LLC. All Rights Reserved.

Important Information for U.S. Investors

Lord Abbett mutual funds are distributed by Lord Abbett Distributor LLC.

FOR MORE INFORMATION ON ANY LORD ABBETT FUNDS, CONTACT YOUR INVESTMENT PROFESSIONAL OR LORD ABBETT DISTRIBUTOR LLC AT 888-522-2388, OR VISIT US AT LORDABBETT.COM FOR A PROSPECTUS, WHICH CONTAINS IMPORTANT INFORMATION ABOUT A FUND'S INVESTMENT GOALS, SALES CHARGES, EXPENSES AND RISKS THAT AN INVESTOR SHOULD CONSIDER AND READ CAREFULLY BEFORE INVESTING.

The information provided is not directed at any investor or category of investors and is provided solely as general information about Lord Abbett’s products and services and to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither Lord Abbett nor its affiliates are undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product, or service may be appropriate for your circumstances.

Important Information for non-U.S. Investors

Note to Switzerland Investors: In Switzerland, the Representative is ACOLIN Fund Services AG, Leutschenbachstrasse 50, CH-8050 Zurich, whilst the Paying Agent is Bank Vontobel Ltd., Gotthardstrasse 43, CH- 8022 Zurich. The prospectus, the key information documents or the key investor information documents, the instrument of incorporation, as well as the annual and semi-annual reports may be obtained free of charge from the representative. In respect of the units offered in Switzerland, the place of performance is at the registered office of the representative. The place of jurisdiction shall be at the registered office of the representative or at the registered office or domicile of the investor.

Note to European Investors: This communication is issued in the United Kingdom and distributed throughout the European Union by Lord Abbett (Ireland) Limited, UK Branch and throughout the United Kingdom by Lord Abbett (UK) Ltd. Both Lord Abbett (Ireland) Limited, UK Branch and Lord Abbett (UK) Ltd are authorized and regulated by the Financial Conduct Authority.

A decision may be taken at any time to terminate the arrangements made for the marketing of the Fund in any EEA Member State in which it is currently marketed. In such circumstances, Shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the Fund free of any charges or deductions for at least 30 working days from the date of such notification.

Lord Abbett (Middle East) Limited is authorised and regulated by the Dubai Financial Services Authority (“DFSA”). The entire content of this document is subject to copyright with all rights reserved. This research and the information contained herein may not be reproduced, distributed or transmitted in any jurisdiction or to any other person or incorporated in any way into another document or other material without our prior written consent. This document is directed at Professional Clients and not Retail Clients. Any other persons in receipt of this document must not rely upon or otherwise act upon it. This document is provided for informational purposes only. Nothing in this document should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction. Nothing contained in this document constitutes an investment, an offer to invest, legal, tax or other advice or guidance and should be disregarded when considering or making investment decisions.

Note to Singapore Investors: Lord Abbett Global Funds I plc (the “Company”) and the offer of shares of each sub-fund of the Company do not relate to a collective investment scheme which is authorized under Section 286 of the Securities and Futures Act, Ch. 289 of Singapore (“SFA”) or recognized under Section 287 of the SFA, and shares in each sub-fund of the Company are not allowed to be offered to the retail public. Pursuant to Section 305 of the SFA, read in conjunction with Regulation 32 of and the Sixth Schedule to the Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations 2005 (the “Regulations”), the Lord Abbett Global Multi-Sector Bond Fund, the Lord Abbett High Yield Fund, the Lord Abbett Short Duration Income Fund, the Lord Abbett Ultra Short Bond Fund, the Lord Abbett Climate Focused Bond Fund, the Lord Abbett Emerging Markets Corporate Debt Fund and the Lord Abbett Multi Sector Income Fund have been entered into the list of restricted schemes maintained by the Monetary Authority of Singapore for the purposes of the offer of shares in such sub-funds made or intended to be made to relevant persons (as defined in section 305(5) of the SFA), or, the offer of shares in such sub-funds made or intended to be made in accordance with the conditions of section 305(2) of the SFA. These materials do not constitute an offer or solicitation by anyone in Singapore or any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

Note to Hong Kong Investors: The contents of this material have not been reviewed nor endorsed by any regulatory authority in Hong Kong. An investment in the Fund may not be suitable for everyone. If you are in any doubt about the contents of this material, you should consult your stockbroker, bank manager, solicitor, accountant or other financial adviser for independent professional advice. The Fund is not authorised by the Securities and Futures Commission ("SFC") in Hong Kong pursuant to Section 104 of the Securities and Futures Ordinance (Cap 571, Laws of Hong Kong) ("SFO"). This material has not been approved by the SFC in Hong Kong, nor has a copy of it been registered with the Registrar of Companies in Hong Kong and, must not, therefore, be issued, or possessed for the purpose of issue, to persons in Hong Kong other than (1) professional investors within the meaning of the SFO (including professional investors as defined by the Securities and Futures (Professional Investors) Rules); or (2) in circumstances which do not constitute an offer to the public for the purposes of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap 32, Laws of Hong Kong) or the SFO. This material is distributed on a confidential basis and may not be reproduced in any form or transmitted to any person other than the person to whom it is addressed.