This is a marketing communication.

In Brief

- Healthy balance sheets and low leverage remain supportive of corporate fundamentals, but we are closely monitoring interest-rate coverage ratios and the consumer in the higher-rate environment.

- Lower policy rates may be a potential tailwind, although some of the positive effect from declining rates may be somewhat checked by wider spreads.

- Given monetary policy uncertainty, we continue to emphasize up-in-quality and up-in-liquidity positioning within an actively managed approach.

Market Recap

Despite some volatility, investment-grade corporates generated strong performance in 2023. The Bloomberg U.S. Corporate Bond Index returned 8.52% for the year, outperforming the Bloomberg U.S. Aggregate Bond Index by 299 basis points (bps), more than doubling the return of the Bloomberg U.S. Treasury Index, and outperforming the Bloomberg U.S. Treasury Bill Index.

Compared to a year ago, inflation pressures have eased, and the U.S. Federal Reserve’s (Fed’s) concern has decidedly shifted from price levels to full employment and economic growth. We believe the Fed may well stay in restrictive territory for much of 2024, as growth continues to be steady, with quarterly gross domestic product (GDP) readings above 2%, and the labor market remains strong, with the unemployment rate still below 4%. We believe this makes for an attractive environment for high-quality credit, but we continue to watch the U.S. consumer very closely, along with the impacts from higher rates.

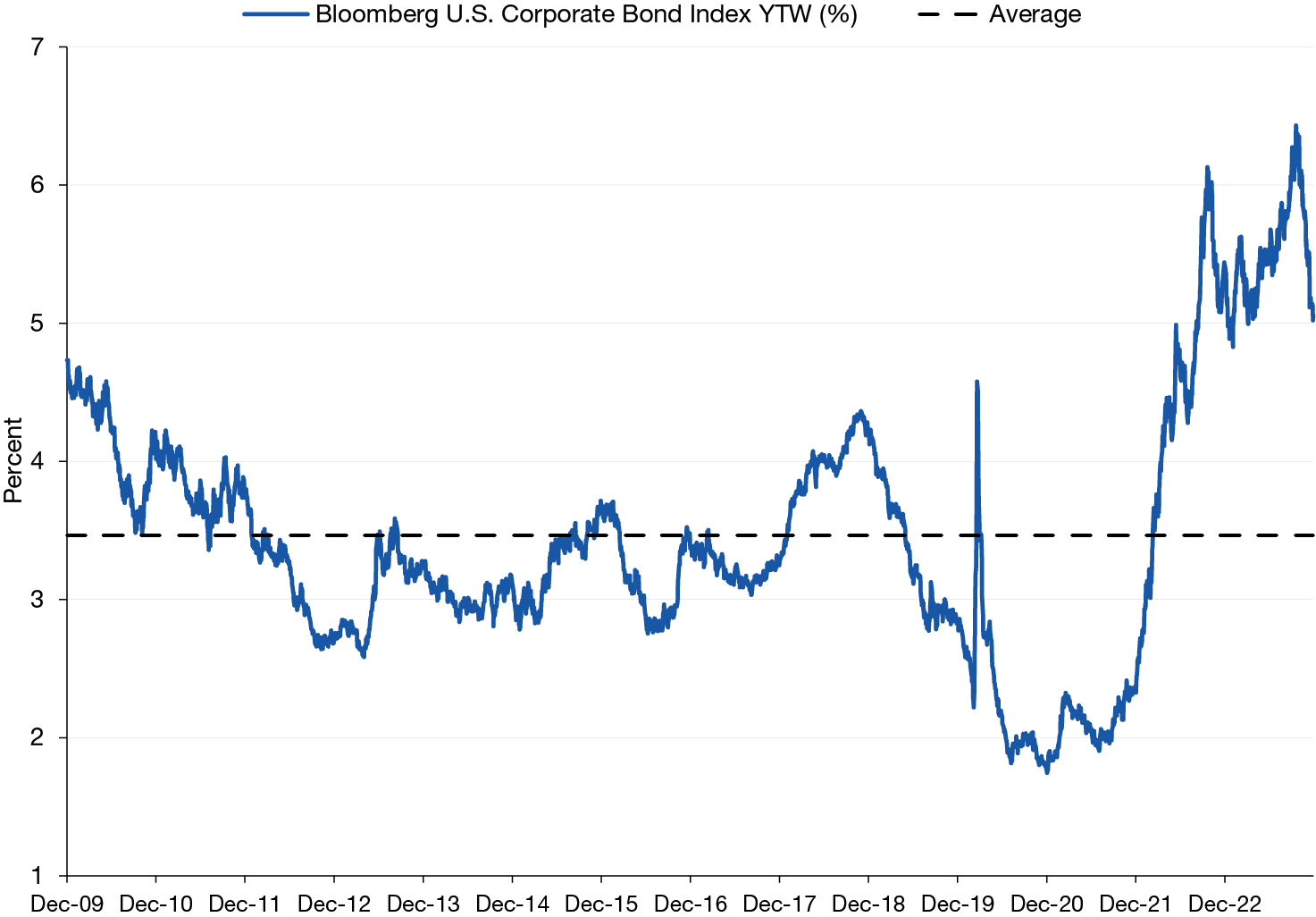

Though fixed-income markets closed out the year with one of the strongest rallies in decades, we believe the case for corporate credit remains compelling. Credit spreads have tightened, given a resilient U.S. economy and a potential Fed pivot, but overall investment-grade corporate yields are currently in the 90th percentile since the Great Financial Crisis and outyield the level of high yield corporates from two years ago.

Figure 1. U.S. Corporate Bond Yields Remain Historically High

While the risks of sticky inflation or an economic contraction remain, we believe that corporate fundamentals are entering the new year in a position of strength. Balance sheets are at healthy levels, and leverage remains relatively low, as corporate America has acted prudently over the last few years. Revenues have held up throughout 2023, and more importantly, companies have shown the ability to pass along higher costs to maintain margins. Therefore, we believe high-quality corporates are well prepared should the U.S. enter an economic slowdown or mild recession. One area we have been watching closely is interest-rate coverage, which has deteriorated somewhat with higher rates, but it’s down from record levels in mid-2022 and still near long-term averages.

It is important to note that high-quality corporate bonds have historically performed well in recessions from a total return perspective, particularly if the Fed cuts rates to support the economy—although some of the returns from falling rates would be given back by wider spreads.

Positioning

As we enter the new year, we believe the front end of the credit curve is showing attractive relative value. While underperforming in 2023, the short end is almost unchanged from a year ago from a spread perspective, and we feel it represents one of the best segments of the curve from a risk/reward standpoint. In terms of technicals, we think that issuance may pick up in the new year, given lower rates relative to the last few months.

We maintain our up-in-quality, up-in-liquidity stance given macroeconomic uncertainty. We believe many companies in the Utility sector are trading at compelling valuations, given elevated supply, to finance environmental initiatives, and we have been buying in at attractive spreads in this non-cyclical, highly regulated industry. We remain conservatively positioned in the financials sector, favoring U.S. money centers and European national champions. Larger European banks are particularly compelling as we feel that the resolution of the Credit Suisse overhang has not been fully priced in. The Energy sector also provides an attractive opportunity set, in our view, and we continue to focus on companies that are deleveraging with solid operating fundamentals.

Past Performance of Selected Indices (calendar year):

About the Contributors

Unless otherwise noted, all discussions are based on U.S. markets and U.S. monetary and fiscal policies.

Asset allocation or diversification does not guarantee a profit or protect against loss in declining markets.

No investing strategy can overcome all market volatility or guarantee future results.

The value of investments and any income from them is not guaranteed and may fall as well as rise, and an investor may not get back the amount originally invested. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance.

Market forecasts and projections are based on current market conditions and are subject to change without notice. Projections should not be considered a guarantee.

Equity Investing Risks

The value of investments in equity securities will fluctuate in response to general economic conditions and to changes in the prospects of companies and/or sectors in the economy. While growth stocks are subject to the daily ups and downs of the stock market, their long-term potential as well as their volatility can be substantial. Value investing involves the risk that the market may not recognize that securities are undervalued, and they may not appreciate as anticipated. Smaller companies tend to be more volatile and less liquid than larger companies. Small cap companies may also have more limited product lines, markets, or financial resources and typically experience a higher risk of failure than large cap companies.

Fixed-Income Investing Risks

The value of investments in fixed-income securities will change as interest rates fluctuate and in response to market movements. Generally, when interest rates rise, the prices of debt securities fall, and when interest rates fall, prices generally rise. High yield securities, sometimes called junk bonds, carry increased risks of price volatility, illiquidity, and the possibility of default in the timely payment of interest and principal. Bonds may also be subject to other types of risk, such as call, credit, liquidity, and general market risks. Longer-term debt securities are usually more sensitive to interest-rate changes; the longer the maturity of a security, the greater the effect a change in interest rates is likely to have on its price.

The credit quality of fixed-income securities in a portfolio is assigned by a nationally recognized statistical rating organization (NRSRO), such as Standard & Poor’s, Moody’s, or Fitch, as an indication of an issuer’s creditworthiness. Ratings range from ‘AAA’ (highest) to ‘D’ (lowest). Bonds rated ‘BBB’ or above are considered investment grade. Credit ratings ‘BB’ and below are lower-rated securities (junk bonds). High-yielding, non-investment-grade bonds (junk bonds) involve higher risks than investment-grade bonds. Adverse conditions may affect the issuer’s ability to pay interest and principal on these securities.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

The views and opinions expressed are as of the date of publication, and do not necessarily represent the views of the firm as a whole. Any such views are subject to change at any time based upon market or other conditions and Lord Abbett disclaims any responsibility to update such views. Lord Abbett cannot be responsible for any direct or incidental loss incurred by applying any of the information offered.

This material is provided for general and educational purposes only. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, or any Lord Abbett product or strategy. References to specific asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations or investment advice.

Please consult your investment professional for additional information concerning your specific situation.

Glossary & Index Definitions

The U.S. Federal Reserve (Fed) is the central bank of the United States. The federal funds (fed funds) rate is the target interest rate set by the Fed at which commercial banks borrow and lend their excess reserves to each other overnight.

Bloomberg U.S. Corporate Bond Index is the corporate component of the U.S. Credit index and is comprised of U.S. dollar-denominated, investment-grade corporate debt securities publicly issued in the U.S. domestic market and registered with the SEC (Securities Exchange Commission).

Spread is the percentage difference in current yields of various classes of fixed-income securities versus Treasury bonds or another benchmark bond measure. A bond spread is often expressed as a difference in percentage points or basis points (which equal one-one hundredth of a percentage point). The option-adjusted spread (OAS) is the measurement of the spread of a fixed-income security rate and the risk-free rate of return, which is adjusted to take into account an embedded option. Typically, an analyst uses the Treasury securities yield for the risk-free rate.

A basis point is one one-hundredth of a percentage point.

Yield is the income returned on an investment, such as the interest received from holding a security. The yield is usually expressed as an annual percentage rate based on the investment's cost, current market value, or face value. Yield-to-worst refers to the lesser of a bond’s (a) yield-to-maturity or (b) the lowest yield-to-call calculated on each scheduled call date.

Bloomberg Index Information

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg owns all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall not have any liability or responsibility for injury or damages arising in connection therewith.

Source ICE Data Indices, LLC (“ICE”), used with permission. ICE PERMITS USE OF THE ICE BofAML INDICES AND RELATED DATA ON AN “AS IS” BASIS, MAKES NO WARRANTIES REGARDING SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BofAML INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THE USE OF THE FOREGOING, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND LORD ABBETT, OR ANY OF ITS PRODUCTS OR SERVICES.

Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

This material is the copyright © 2024 of Lord, Abbett & Co. LLC. All Rights Reserved.

Important Information for U.S. Investors

Lord Abbett mutual funds are distributed by Lord Abbett Distributor LLC.

FOR MORE INFORMATION ON ANY LORD ABBETT FUNDS, CONTACT YOUR INVESTMENT PROFESSIONAL OR LORD ABBETT DISTRIBUTOR LLC AT 888-522-2388, OR VISIT US AT LORDABBETT.COM FOR A PROSPECTUS, WHICH CONTAINS IMPORTANT INFORMATION ABOUT A FUND'S INVESTMENT GOALS, SALES CHARGES, EXPENSES AND RISKS THAT AN INVESTOR SHOULD CONSIDER AND READ CAREFULLY BEFORE INVESTING.

The information provided is not directed at any investor or category of investors and is provided solely as general information about Lord Abbett’s products and services and to otherwise provide general investment education. None of the information provided should be regarded as a suggestion to engage in or refrain from any investment-related course of action as neither Lord Abbett nor its affiliates are undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity. If you are an individual retirement investor, contact your financial advisor or other fiduciary about whether any given investment idea, strategy, product, or service may be appropriate for your circumstances.

Important Information for non-U.S. Investors

Note to Switzerland Investors: In Switzerland, the Representative is ACOLIN Fund Services AG, Leutschenbachstrasse 50, CH-8050 Zurich, whilst the Paying Agent is Bank Vontobel Ltd., Gotthardstrasse 43, CH- 8022 Zurich. The prospectus, the key information documents or the key investor information documents, the instrument of incorporation, as well as the annual and semi-annual reports may be obtained free of charge from the representative. In respect of the units offered in Switzerland, the place of performance is at the registered office of the representative. The place of jurisdiction shall be at the registered office of the representative or at the registered office or domicile of the investor.

Note to European Investors: This communication is issued in the United Kingdom and distributed throughout the European Union by Lord Abbett (Ireland) Limited, UK Branch and throughout the United Kingdom by Lord Abbett (UK) Ltd. Both Lord Abbett (Ireland) Limited, UK Branch and Lord Abbett (UK) Ltd are authorized and regulated by the Financial Conduct Authority.

A decision may be taken at any time to terminate the arrangements made for the marketing of the Fund in any EEA Member State in which it is currently marketed. In such circumstances, Shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the Fund free of any charges or deductions for at least 30 working days from the date of such notification.

Lord Abbett (Middle East) Limited is authorised and regulated by the Dubai Financial Services Authority (“DFSA”). The entire content of this document is subject to copyright with all rights reserved. This research and the information contained herein may not be reproduced, distributed or transmitted in any jurisdiction or to any other person or incorporated in any way into another document or other material without our prior written consent. This document is directed at Professional Clients and not Retail Clients. Any other persons in receipt of this document must not rely upon or otherwise act upon it. This document is provided for informational purposes only. Nothing in this document should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction. Nothing contained in this document constitutes an investment, an offer to invest, legal, tax or other advice or guidance and should be disregarded when considering or making investment decisions.